“Precise Tax Consultants” appears to be a hypothetical or generic name for a tax consulting firm, but it’s not associated with any specific company or entity that I can reference. However, I can provide you with an overview of what a tax consulting firm with that name might offer based on industry standards:

Precise Tax Consultants could potentially offer a range of services related to taxation and financial advisory, including:

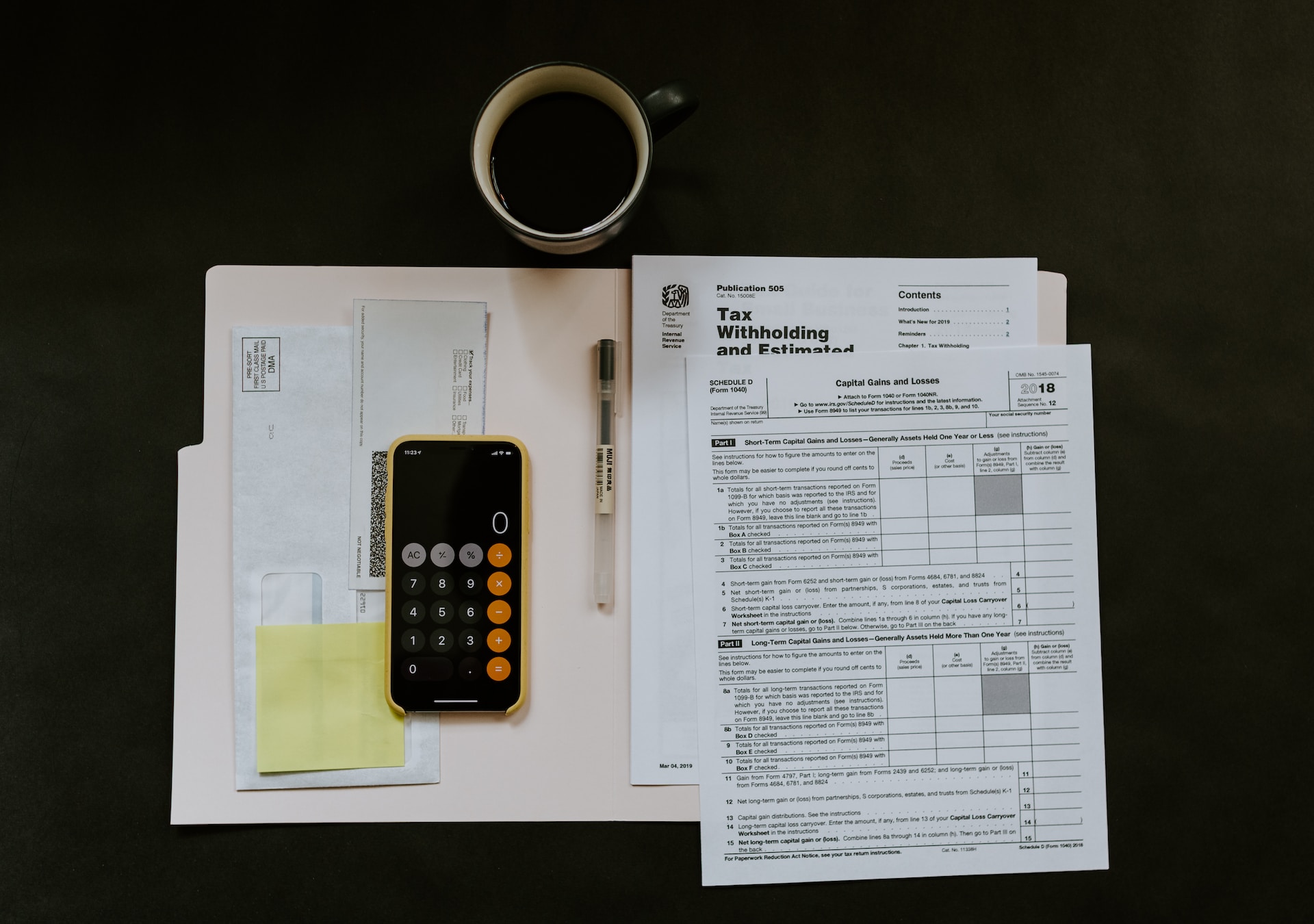

- Tax Preparation: Assisting individuals and businesses in preparing and filing tax returns, ensuring compliance with current tax laws and maximizing eligible deductions.

- Tax Planning: Providing strategic advice to minimize tax liabilities in the short and long term. This might involve year-round planning, considering investments, deductions, and credits to optimize tax outcomes.

- Corporate Tax Services: Assisting businesses with complex tax matters, such as corporate tax planning, compliance, and strategies for minimizing tax burdens.

- Consulting Services: Offering specialized advice on tax-related issues, such as estate planning, international tax matters, mergers and acquisitions, and restructuring.

- Financial Advisory: Providing comprehensive financial advice that considers tax implications, helping clients make informed decisions regarding investments, retirement planning, and wealth management.

- Compliance and Representation: Assisting clients in dealing with tax audits, inquiries, and representing them before tax authorities when needed.

The hallmark of a firm named “Precise Tax Consultants” might be their commitment to accuracy, attention to detail, and a personalized approach to meeting their clients’ tax and financial needs. They could differentiate themselves through their precision in navigating intricate tax codes, ensuring clients are well-informed and compliant while optimizing their financial positions.